Are you asking for 'mm hypothesis'? You will find all the information on this section.

Table of contents

- Mm hypothesis in 2021

- Modigliani and miller theory pdf

- Mm proposition 1

- Criticism of mm-theory of capital structure

- M&m proposition 1 and 2 (with taxes)

- Mm proposition i with taxes states that:

- Value of levered firm formula

- Modigliani and miller 1958

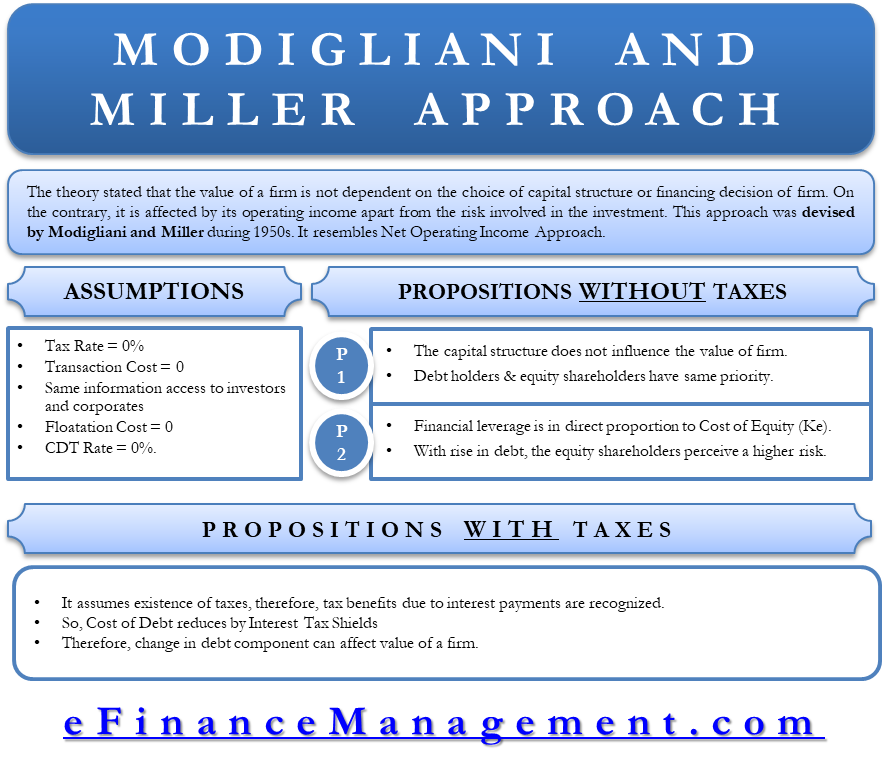

Mm hypothesis in 2021

This image shows mm hypothesis.

This image shows mm hypothesis.

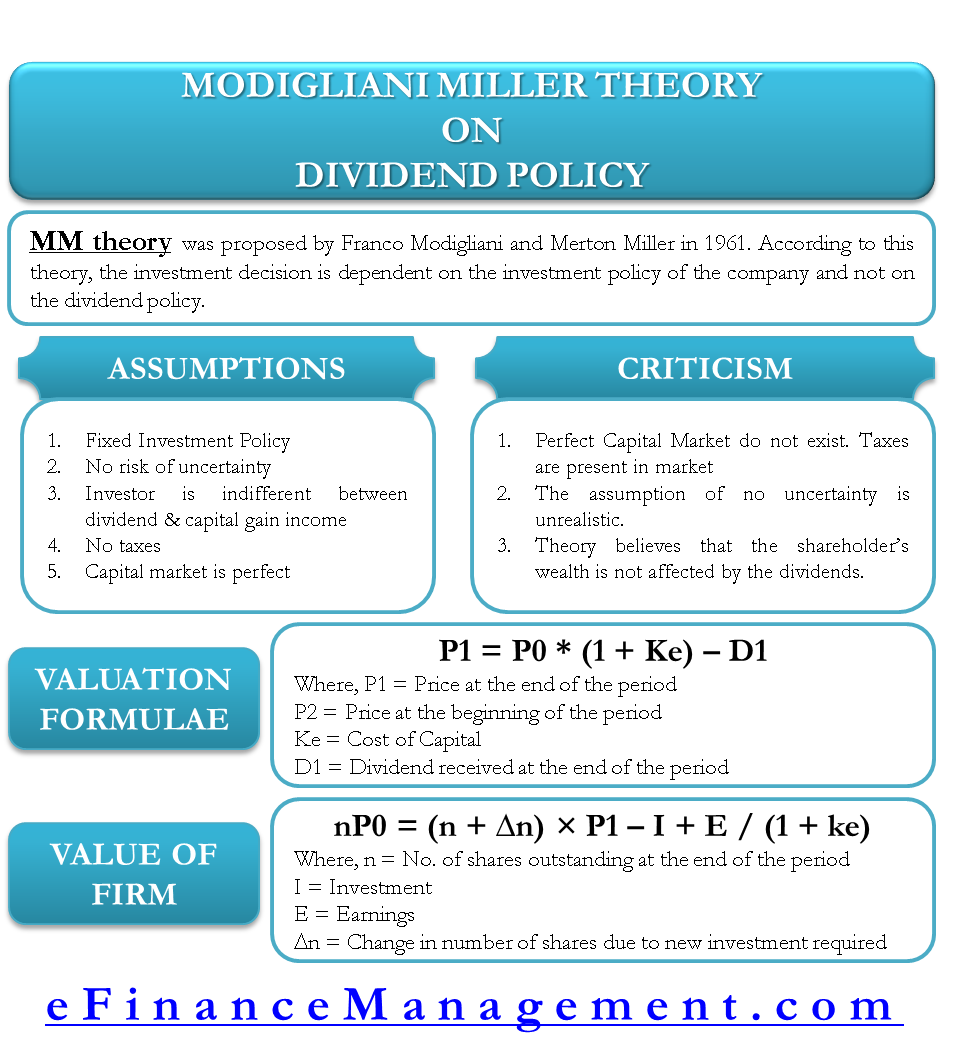

Modigliani and miller theory pdf

This picture illustrates Modigliani and miller theory pdf.

This picture illustrates Modigliani and miller theory pdf.

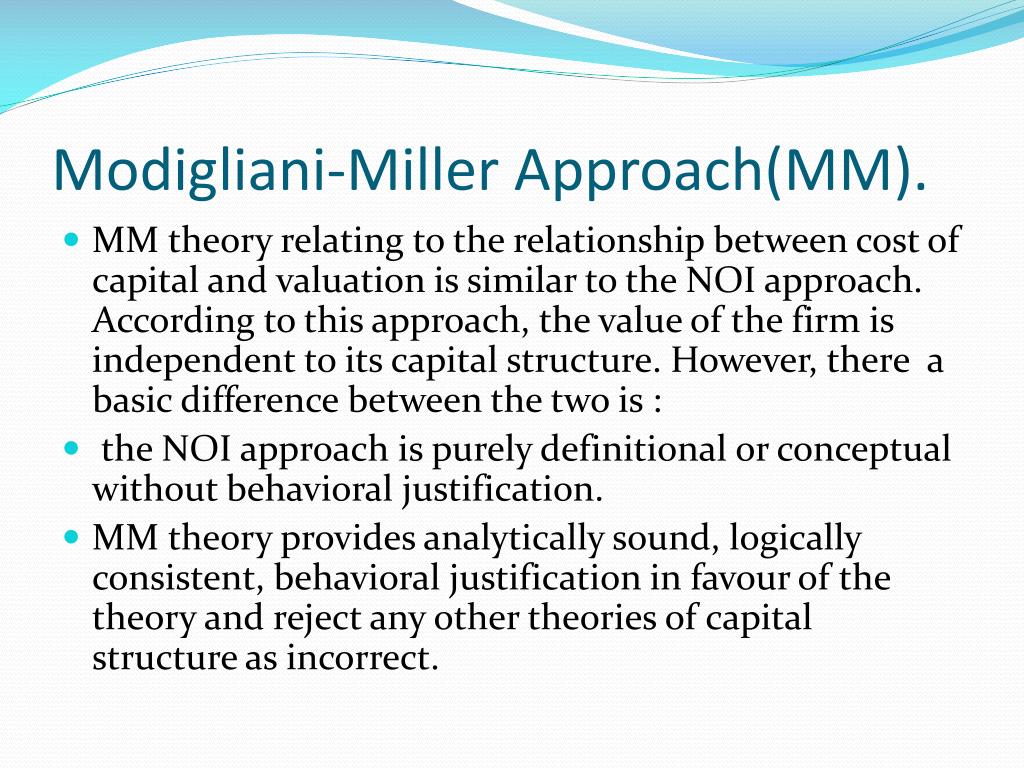

Mm proposition 1

This picture representes Mm proposition 1.

This picture representes Mm proposition 1.

Criticism of mm-theory of capital structure

This image illustrates Criticism of mm-theory of capital structure.

This image illustrates Criticism of mm-theory of capital structure.

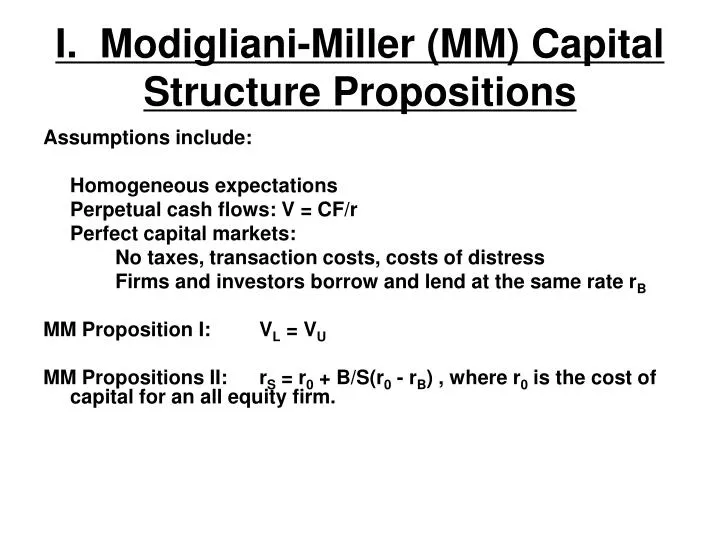

M&m proposition 1 and 2 (with taxes)

This picture illustrates M&m proposition 1 and 2 (with taxes).

This picture illustrates M&m proposition 1 and 2 (with taxes).

Mm proposition i with taxes states that:

This image representes Mm proposition i with taxes states that:.

This image representes Mm proposition i with taxes states that:.

Value of levered firm formula

This picture shows Value of levered firm formula.

This picture shows Value of levered firm formula.

Modigliani and miller 1958

This picture representes Modigliani and miller 1958.

This picture representes Modigliani and miller 1958.

What is the major assumption of pure mm hypothesis?

Definition: Miller and Modigliani Hypothesis or MM Approach supports the “dividend irrelevance theory”, stating that the dividends are irrelevant and has no effect on the firm's share value. Furthermore, what is the major assumption of pure MM theory?

How is the m.m.hypothesis used in investing?

In other words; investors are able to forecast future prices and dividends with certainty. According to the M.M. hypothesis, the crux of the matter is the “arbitrage process” or the switching and balancing operation. It also refers to the simultaneous movement of two transactions which exactly offset each other.

What are the limitations of the M M hypothesis?

After reading this article you will learn about the M.M. Hypothesis:- 1. Assumptions of M.M. Hypothesis 2. Limitations of M.M. Hypothesis. 1. (i) Perfect capital markets; (v) No investor is large enough to influence market price of securities; (vi) There are no floatation costs. 2. There are no taxes.

Are there any problems with the mm Model?

Some of the problems of MM approach are due to imperfect markets, transaction costs, floatation costs and uncertainty of future capital gains and the preference for current dividends. These are listed out. MM model assumes that there are perfect capital markets.

Last Update: Oct 2021

Leave a reply

Comments

Sho

27.10.2021 02:04What artists did the song mm- mm- mm- mm- mm- mm in the 1960's? The fundamentals of the modigliani and miller approach resemble that of the net operating income approach.