Are you ready to discover 'debt assignment accounting'? You will find all the information on this section.

Table of contents

- Debt assignment accounting in 2021

- Assignment of debt meaning

- Assignment of accounts receivable

- Transfer of debt form

- Assignment of accounts receivable agreement

- Assignment of accounts receivable vs factoring

- Assignment and assumption agreement template

- Assignment of debt requirements

Debt assignment accounting in 2021

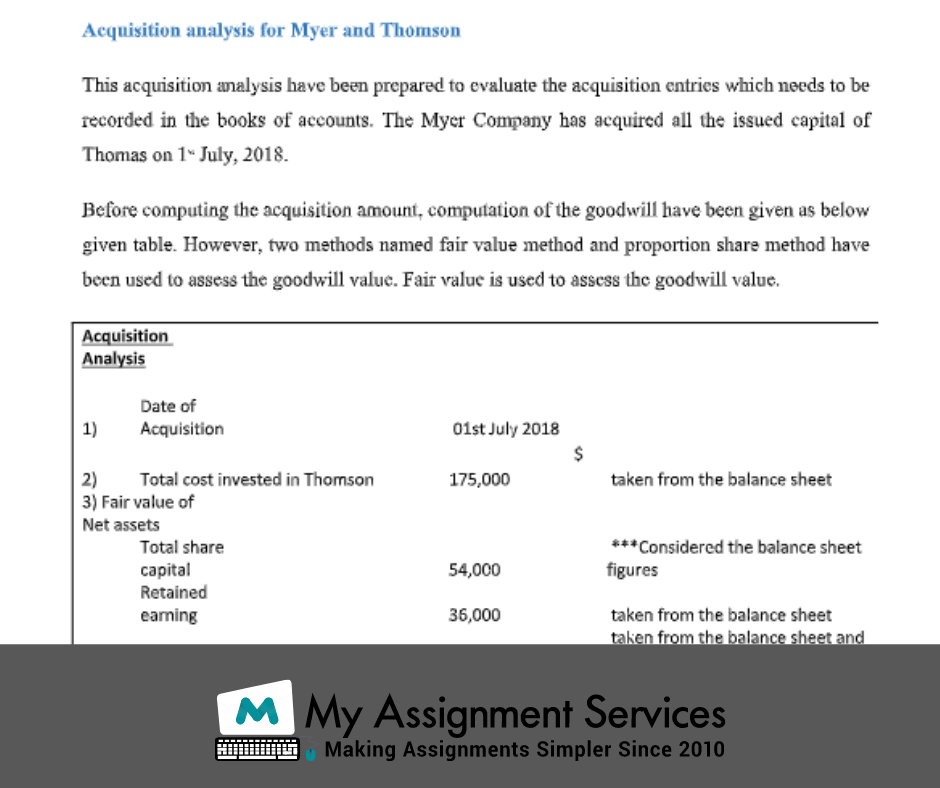

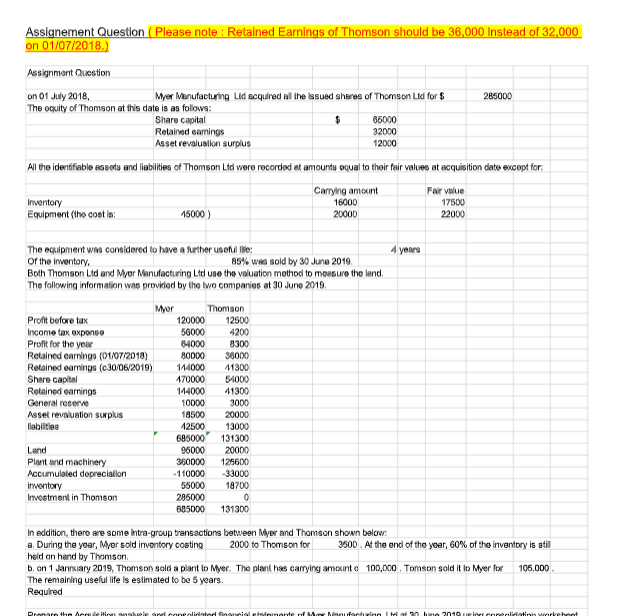

This image demonstrates debt assignment accounting.

This image demonstrates debt assignment accounting.

Assignment of debt meaning

This image representes Assignment of debt meaning.

This image representes Assignment of debt meaning.

Assignment of accounts receivable

This image shows Assignment of accounts receivable.

This image shows Assignment of accounts receivable.

Transfer of debt form

This picture shows Transfer of debt form.

This picture shows Transfer of debt form.

Assignment of accounts receivable agreement

This image shows Assignment of accounts receivable agreement.

This image shows Assignment of accounts receivable agreement.

Assignment of accounts receivable vs factoring

This picture illustrates Assignment of accounts receivable vs factoring.

This picture illustrates Assignment of accounts receivable vs factoring.

Assignment and assumption agreement template

This image demonstrates Assignment and assumption agreement template.

This image demonstrates Assignment and assumption agreement template.

Assignment of debt requirements

This picture representes Assignment of debt requirements.

This picture representes Assignment of debt requirements.

What is assignment of credit?

An assignment of letter of credit proceeds is an assignment (or transfer) of future debt payable under a letter of credit from the beneficiary to another person (ie, the assignee). It enables the assignee, instead of the beneficiary, to receive payment under the letter of credit.

What is assignment of debt agreement?

Debt Assignment Agreement. This agreement allows a debt to be assigned to another pary to be repaid. Accurate and detailed answers to the questions will ensure a better quality final document.

What is proof of debt assignment?

Documentation from the original creditor such as original account statements, original signed credit or loan agreement can be viewed as sufficient proof. If the debt collector claims they were assigned the debt from the original creditor then you should request proof of the assignment.

What is a debt document?

Definition of Debt Document Debt Document means any credit agreement, indenture, guarantee, security agreement, mortgage, deed of trust, letter of credit, reimbursement agreement, waiver, amendment or other contract, agreement, instrument or document relating to Indebtedness of the Corporation or its Subsidiaries.

Last Update: Oct 2021